Hurst Insurance and Financial Services

What is Medicare Supplement Insurance?

A Comprehensive Guide to Medicare Supplement Insurance

Medicare is the federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD).

What are the different parts of Medicare and what services do they cover?

Medicare Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Typically 80% after a deductible.

Medicare Part B covers certain doctors’ services, outpatient care, medical supplies, and preventive services. Typically 80% after a deductible.

Medicare Part C (Medicare Advantage Plan) is a type of Medicare health plan offered by a private company that contracts with Medicare to provide you with all your Part A and Part B benefits. Medicare Advantage Plans include Health Maintenance Organizations, Preferred Provider Organizations, Private Fee-for-Service Plans, Special Needs Plans, and Medicare/Medical Savings Account Plans. If you’re enrolled in a Medicare Advantage Plan, Medicare services are covered through the plan and aren’t paid for under Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage.

Medicare Part D (Prescription Drug Coverage) adds prescription drug coverage to Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans, and Medicare Medical Savings Account Plans. These plans are offered by insurance companies and other private companies approved by Medicare. Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare Prescription Drug Plans.

ENROLL IN PART D

Medicare Supplement Plan F

Medicare Supplement Plan F is the most comprehensive plan out of the eleven available Medigap policies. Because Plan F leaves the beneficiary with no out-of-pocket expenses, by covering any remaining hospital and doctor costs after Original Medicare (Part A and/or B) has covered its portion, it is the most expensive supplement plan.

Since Plan F is so popular, most Medigap carriers sell it. The coverage for plan F does not change from company to company, but the cost may vary.

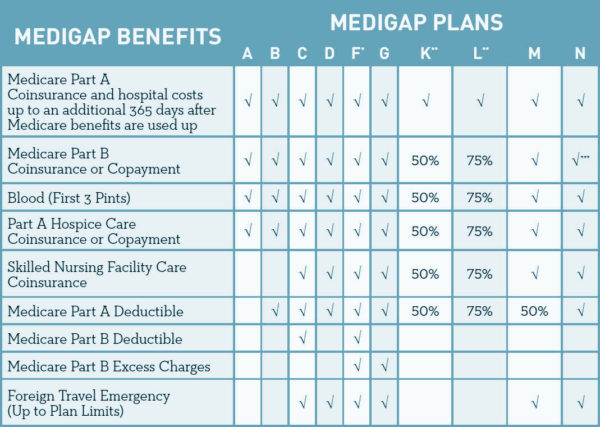

The following is a list of costs and benefits covered by Medicare Supplement Plan F:

- Part A deductible covered at 100%

- Part B deductible covered at 100%

- Part B excess charges covered at 100%

- Preventative care Part B coinsurance covered at 100%

- Part A hospital and coinsurance costs up to an additional 356 days after Medicare benefits are exhausted

- Part B coinsurance or copayment covered at 100%

- First three pints of blood used in an approved medical procedure (annually)

- Part A hospice care copayment or coinsurance

- Skilled Nursing Facility (SNF) coinsurance

- Foreign travel emergency

Medicare Supplement Plan G

Plan G is a lot like Plan F, in that they both offer comprehensive coverage and are among the most robust Medigap offerings, but Plan G requires the beneficiary to pay the Medicare Part B deductible out-of-pocket. In 2015, the standard Part B deductible amount is $147, and once you’ve met the deductible you have 100% coverage.

Plan G is not the most popular plan and not all companies offer it. Some companies determined that the profit margin is not high enough to offer the plan. What that means is that they don’t make enough money off of you so they don’t want to offer it. They are looking out for themselves and not the client.

The following is a list of costs and benefits covered by Medicare Supplement Plan G:

- Medicare Part A hospital coinsurance and all costs up to 365 days after Original Medicare benefits are exhausted

- Part A hospice care coinsurance or copayment

- Part A deductible at 100%

- Medicare Part B preventive care coinsurance coverage at 100%

- Part B coinsurance or copayment coverage at 100%

- Part B excess charges at 100%

- Skilled Nursing Facility (SNF) care coinsurance coverage

- Foreign travel emergency coverage

Common Medigap Questions

No. There are different Medicare Supplements to choose from which are all standardized by Medicare. So Plan F with one company is the same as Plan F with a different company. ALL Medigap companies offer the EXACT same basic benefits. The only difference is in the price, THAT’S IT.

The best time to buy a Medigap policy is during your Medigap OPEN ENROLLMENT Period. This 6-month period begins on the first day of the month in which you’re 65 or older and enrolled in Part B (some states have additional Open Enrollment Periods). After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more. If you delay enrolling in Part B because you have group health coverage based on your (or your spouse’s) current employment, your Medigap Open Enrollment Period won’t start until you sign up for Part B.

A Medigap policy only covers one person, spouses have to buy a separate policy.

As many times as you like, as long as your health permits!

Yes! If you do not have a Medigap plan (Medicare Supplement), you are responsible for everything that is not covered by Medicare! A Supplement is very important because it will help pay your Medicare deductibles and coinsurance.

How can Hurst Insurance & Financial Services help?

We realize that there is a lot of overwhelming information that can make it frustrating in choosing the right coverage or company. This is where we come in. We can do it all for you, for FREE! We provide unbiased, personalized information in helping you with the process of making the right decision in which company to choose from. We do not have any loyalty towards any one particular company. Our loyalty is to you!

We are here to guide you through the process. Our specialists are available to discuss your unique situation. We want to ensure you are comfortable with your insurance program and understand what it covers. Please feel free to contact us if we can help in any way.